When dealing with the finances of a company, extra caution needs to be taken as the business’ success can drop from 100 to 0 very quickly if something goes wrong in the

accounting processes and within the accounting firm.

Watch out for these areas of vulnerability in order to maintain financial safety and governance.

1. Data Breach

This unfortunate occurrence is too common as even the smallest slip-up can expose financial records and confidential information. This information may be lost or accidentally shared with the world.

Not only can this happen due to a lack of cyber security and firewalls, but also careless mistakes made by the employee which may involve exposing a client’s confidential information. To avoid this happening, keep software up to date and secure and make sure all employees are trained in information technology use.

2. Client Lawsuits

A professional liability lawsuit can occur when the firm gives bad investment advice, provides inaccurate tax returns or due to a different mistake.

Accounting Web states that 11 percent of all accounting malpractice lawsuits come from mistakes in bookkeeping and miscommunications with clients about their expectations for

your work. Complete consistency and accuracy is required in order to avoid this happening.

3. Client Injury

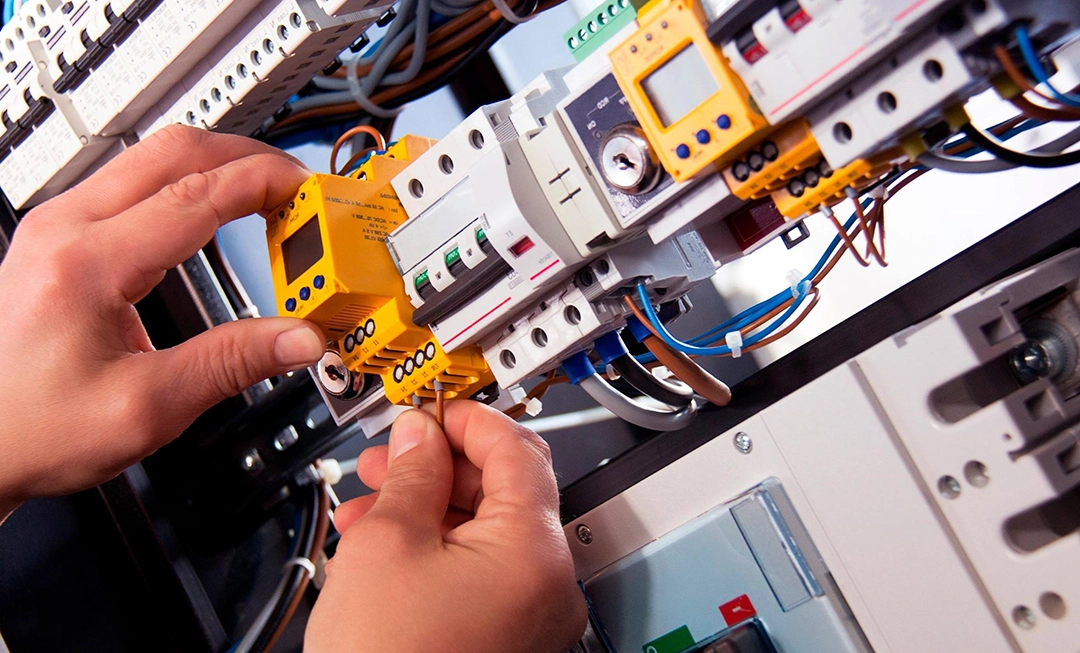

Believe it or not, this is a major threat to accounting firms. If a client is somehow injured within your firm, the company is liable for the damages inflicted on him/her. For example, a

client visits the office and trips on a power cord and breaks their leg. The firm will most likely be responsible for treatment costs as well as covering

The firm will most likely be responsible for treatment costs as well as covering compensation for the pain and suffering that the client has endured. Liability insurance as well as plant layout monitoring and improvement will help to prevent these incidents from occurring and creating costs for the business.

Be sure to know your legal rights both as an individual and as a firm before practicing with both employees and clients. Watching out for these risks can increase security within your firm’s practices and ensure that the business does not face any serious threats that could have been avoided.